Since its inception, the Consumer Financial Protection Bureau (CFPB) has penalized a wide variety of companies and people for violating federal consumer financial protection laws. The CFPB has the authority to issue penalties for violations of a range of laws, but the majority of fines issued to date have been for violations of several specific statutes, most often the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

The damages assessed by the CFPB vary widely from case to case – the Bureau has issued fines ranging from $1 to over $2 billion to different companies in different circumstances. insideARM has tallied up the penalties and found that, to date, the CFPB has ordered over $5 billion in total penalties since opening for business.

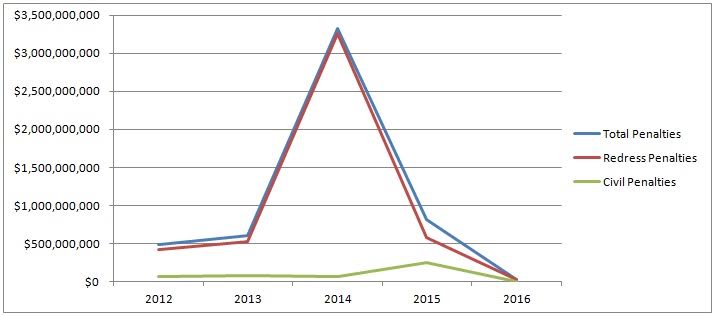

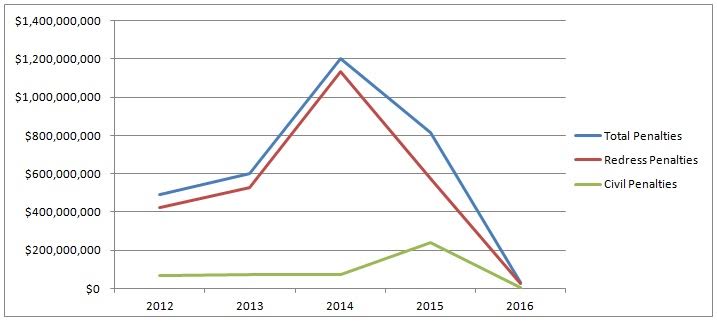

As you can see in the chart above, 2014 was a big year for the CFPB. The Bureau ended up issuing more than $3 billion in fines in 2014 alone, more than $2 billion of those penalties coming in one case involving Ocwen Financial Corp. and Ocwen Loan Servicing, LLC, a case that dealt with mortgage servicing violations. Other big CFPB targets over time have been financial institutions like Bank of America, Synchrony Bank, and JPMorgan Chase. When you subtract the Ocwen outlier from the equation (see chart below), you can see a better picture of how the CFPB issues penalties, generally ordering between $500 million and $1 billion in fines annually. If past trends hold, the CFPB is likely to act on at least a few more occasions this year.

As you can see in the chart above, 2014 was a big year for the CFPB. The Bureau ended up issuing more than $3 billion in fines in 2014 alone, more than $2 billion of those penalties coming in one case involving Ocwen Financial Corp. and Ocwen Loan Servicing, LLC, a case that dealt with mortgage servicing violations. Other big CFPB targets over time have been financial institutions like Bank of America, Synchrony Bank, and JPMorgan Chase. When you subtract the Ocwen outlier from the equation (see chart below), you can see a better picture of how the CFPB issues penalties, generally ordering between $500 million and $1 billion in fines annually. If past trends hold, the CFPB is likely to act on at least a few more occasions this year.

Types of Penalties

Types of Penalties

The CFPB issues two main types of fines when announcing their enforcement actions – redress and civil penalties. They are similar in the sense that both are assessed for violations of consumer financial protection laws, but there are differences in where penalty payments go and the purpose they serve.

The largest fines assessed by the CFPB are usually redress penalties, which the Bureau says are designed to compensate consumers for the harm caused by a particular person or company. Redress payments are normally distributed by the penalized party directly to consumers, but in some instances the CFPB requires “Bureau-administrated redress,” where the payment goes to the CFPB to then be redistributed among victims.

The other major type of fine assessed by the CFPB is called a civil penalty, which is put into the federal Civil Penalty Fund established by the Dodd-Frank Act. That money doesn’t just go towards the CFPB’s operating expenses – the Bureau says the money goes either towards “payments to people who were harmed by the illegal actions that gave rise to civil penalties and who aren’t expected to otherwise get full compensation” or towards “consumer education and financial literacy programs designed to help consumers.” That said, the CFPB reserves the right to disperse the Civil Penalty Fund as it sees fit, saying that the Bureau can use money from the Fund to “pay any eligible victim from any case” at its discretion.

Penalized Actions

The main thing ARM companies need to watch out for in order to stay compliant and avoid a CFPB penalty are so-called “unfair, deceptive, or abusive acts and practices,” also known as UDAAPs. The prohibitions and penalties related to such acts and practices are based in Sections 1031 and 1036 of the Dodd-Frank Act, which says that an act or practice is “unfair” if it can cause substantial injury to consumers, is not reasonably avoidable, and is not outweighed by countervailing benefits to consumers or competition; that an act or practice is “deceptive” if it misleads a consumer or could be perceived as misleading in any way; and that an act or practice is “abusive” if it materially interferes with a consumer’s understanding of a product or takes unreasonable advantage of a consumer. The vast majority of enforcement actions by the CFPB, especially actions related to debt collection, cite some sort of UDAAP as the basis for a fine.

Three recent cases highlight the CFPB’s tendency to focus on UDAAP violations when regulating the ARM industry.

Most recently, in February the Bureau fined Citibank and two of its affiliates – Department Stores National Bank and CitiFinancial Servicing, LLC – $4.89 million in redress and a $3 million civil penalty for selling credit card debt with inflated interest rates, failing to forward consumer payments promptly to debt buyers, and falsifying court documents.

In October, the CFPB ordered the Security National Automotive Acceptance Company to pay a $2.27 million redress penalty and $1 million civil penalty for exaggerating potential disciplinary action that consumers would face, contacting consumers’ supervisors about their debt, falsely threatening to garnish wages, and misleading consumers about imminent legal action.

Finally, last September, the CFPB also fined Encore Capital Group and Portfolio Recovery Associates for purchasing debts they should have known were inaccurate and attempt to collect those debts through unlawful means. Encore Capital Group was fined $42 million in redress and a $10 million civil penalty, while PRA was penalized $19 million in redress and an $8 million civil penalty.

Other laws which are often cited in enforcement actions by the CFPB include the Federal Trade Commission Act, the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, the Equal Credit Opportunity Act, the Home Mortgage Disclosure Act, the Real Estate Settlement Procedures Act of 1974, the Truth in Lending Act, and the Truth in Savings Act.

insideARM Perspective

If you’re wondering what your agency specifically needs to watch out for in order to remain compliant and avoid costly enforcement proceedings, insideARM suggests a thorough review of the July 10, 2013 bulletin on “Unfair, Deceptive, or Abusive Acts or Practices in the Collection of Consumer Debts.”

In that bulletin, the Bureau says they will be “closely” monitoring the following unfair, deceptive, or abusive acts and practices:

- Collecting or assessing a debt and/or any additional amounts in connection with a debt not expressly authorized by the agreement creating the debt or permitted by law.

- Failing to post payments timely or properly or to credit a consumer’s account with payments that the consumer submitted on time and then charging late fees to that consumer.

- Taking possession of property without the legal right to do so.

- Revealing the consumer’s debt, without the consumer’s consent, to the consumer’s employer and/or co-workers.

- Falsely representing the character, amount, or legal status of the debt.

- Misrepresenting that a debt collection communication is from an attorney.

- Misrepresenting that a communication is from a government source or that the source of the communication is affiliated with the government.

- Misrepresenting whether information about a payment or non-payment would be furnished to a credit reporting agency.

- Misrepresenting to consumers that their debts would be waived or forgiven if they accepted a settlement offer, when the company does not, in fact, forgive or waive the debt.

- Threatening any action that is not intended or the covered person or service provider does not have the authorization to pursue, including false threats of lawsuits, arrest, prosecution, or imprisonment for non-payment of a debt.

As long as you and your company avoid those sorts of acts and practices, you will go a long way towards avoiding penalties from the CFPB.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)