Yesterday the Consumer Financial Protection Bureau (CFPB) released its first monthly report on consumer complaints. The Monthly Complaint Report provides a high-level snapshot of trends.

Key findings among all complaint categories for February-April 2015:

- Although still the category with the most complaints in 2015 (7,286), debt collection complaints fell by 7% when comparing the three month period of April – June 2014 to the same period in 2015. The products with the biggest growth over the same period were consumer loans (55%) and credit reporting (27%).

- Although not the state with the most complaints, Washington, D.C. has the highest number of total complaints per 100k population, at 577. Next are Delaware (371), Maryland (333), and Florida (315). Since inception, California has the most total complaints (90,521), followed by Florida (62,670) and Texas (50,518).

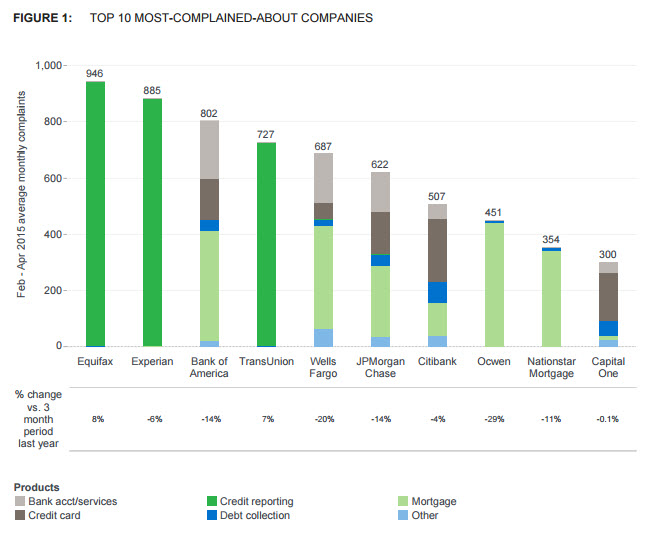

- By far, the currently most complained about organizations (as measured by average monthly complaints between February and April 2015) are the big three credit reporting companies, Equifax (946 complaints), Experian (885), and TransUnion (727) – interrupted only by Bank of America (802), with the lions’ share of those related to mortgages, bank account/services, and credit cards.

- Companies in the Top 10 with significant drops in complaint volume since the year before include Ocwen (-29%) and Wells Fargo (-20%), with a tie for third among Bank of America and JPMorgan Chase (both -14%).

Key findings within debt collection complaints for February-April 2015:

- The most common type of collection complaint (37% of the total) continues to be “continued attempts to collect debt not owed,” followed by “communication tactics” (20%). This was the case when the CFPB first began reporting on debt collection complaints in 2013 (continued attempts to collect debt not owed 41%, communication tactics 19.8%), and it was the case when the Federal Trade Commission (FTC) was the primary repository of collection complaints.

- Many complaints about continued attempts to collect debt center around consumer’s assertions that the calculation of the amount of underlying debt is inaccurate.

- West Virginia (35%), Utah (16%), and Washington (16%) experienced the greatest percentage increase in complaints during the same period in 2015 vs. 2014.

- The states with the most complaints per 100k population are Washington, D.C. (122), Delaware (95), and Nevada (75).

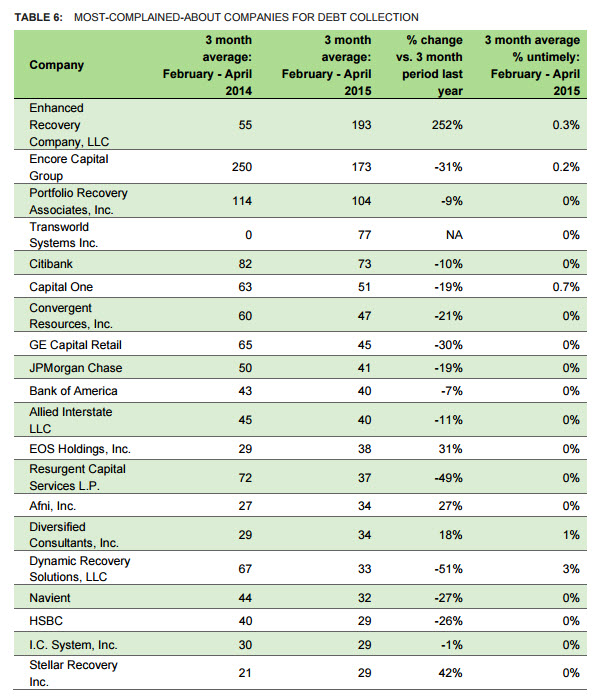

- The most-complained-about companies for debt collection for the reporting period include Enhanced Recovery Company, LLC (193 complaints), Encore Capital Group (173 complaints), and Portfolio Recovery Associates, Inc. (104 complaints).

- Of the top twenty most-complained about companies for debt collection, fourteen experienced a decrease in complaints from 2014 to 2015.

insideARM Perspective

insideARM reported on Forbes several years ago (we also published a comprehensive Complaints Compendium for 2012) that in the first quarter of 2012 there were approximately 50,000 complaints lodged against debt collectors with the FTC. Ten thousand of those (20%) were against unknown companies. After a painstaking process of normalization, we found that thousands more were against rogue operators whose numbers were no longer in service, or did not identify themselves in the way that legitimate companies do. I estimated that the true percentage of complaints against actual legitimate firms was likely 30-40% of the total.

Unlike the FTC, the CFPB verifies (not the validity) but the subject of each complaint so that it can be forwarded to a known human being for response. Otherwise, the complaint is not counted in the CFPB’s statistics. Indeed, for the second quarter of 2015, the CFPB recorded approximately 7,300 debt collection complaints – less than 15% of the volume reported by the FTC.

Worth noting is the fact that the greatest number of collection complaints continues to be related to attempts to collect debt not owed, or an inaccurate accounting of the underlying debt — a factor typically driven by the owner of the debt rather than the 3rd party collection agency. This, among other factors, helps to explain why the most complained about firms tend to include creditors and debt buyers. It also helps to explain why the CFPB has signaled that its much anticipated Debt Collection Rulemaking will eliminate the separation of accountability between creditors collecting on their own behalf and their service providers.

It also bears noting that even in the case of the state with the most debt collection complaints per 100k population (Washington, D.C.), 122 complaints represents a 0.12% “defect” rate.

insideARM contacted ERC regarding this article and Mark A. Thompson, Chairman and Co-Founder, offered this comment:

“ERC has one of the largest and most diverse client portfolios in the country. With over 27 million open accounts and 56 million active accounts currently residing on our system during this measurement period, 193 complaints represents .0007% (or 7 ten thousandths of 1 percent) of just our open accounts, not counting the other 29 million closed, but active accounts on our system for which complaints do sometimes arise.

We do not take any increases in complaints lightly. However, it would certainly be more meaningful reporting on the part of the CFPB if they were to state complaints as a percentage of open customer accounts being handled by each entity. That would add an appropriate degree of relevance to their findings and enable the public to decide if an organization is operating within acceptable compliance standards.”

In related news, the CFPB recently posted a Request for Information Regarding the Consumer Complaint Database: Data Normalization. Interested parties were given sixty days to submit comments; the deadline is August 30, 2015.

[article_ad]

![Stephanie Eidelman [Image by creator from ]](/media/images/Stephanie_Eidelman-12.8.19.7e612703.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)