The number of debt collection complaints published by the CFPB in the second quarter of 2014 virtually mirrors the number published in the previous quarter. In Q2, the CFPB published 10,265 complaints related to debt collection compared to 10,231 in Q1.

Moreover, many of the most notable categories saw little, if any, change from the previous quarter.

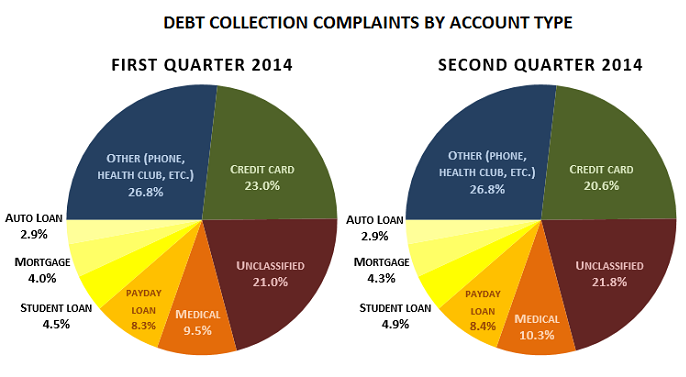

The type of account consumers claimed led to the complaint on aggregate were very similar to earlier in the year, with Other accounts (mostly non-financial debt like phone bills or health club memberships) being the most prevalent in both quarters at 26.8 percent of all collection complaints in both periods. Credit cards accounted for 20.6 percent of complaints in Q2, compared to 23 percent in Q1, while Unclassified complaints moved from 21 percent to 21.8 percent.

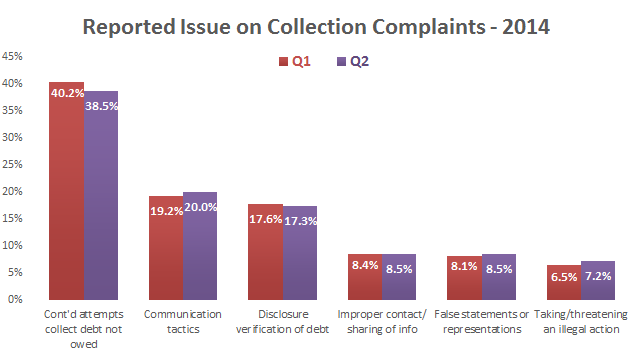

The primary issue reported by consumers in the complaints was very similar quarter-over-quarter. “Continued attempts collect debt not owed” was, by far, the most common issue with 38.5 percent of consumers citing that reason, compared to 40.2 percent in Q1. Exactly 20 percent of consumer complained about “Communication tactics” in Q2, up slightly from 19.2 percent in the previous quarter.

The most common sub-issue continued to be “Debt is not mine,” accounting for 24.1 percent of all complaints in Q2, down slightly from 25.3 percent in Q1.

The most common sub-issue continued to be “Debt is not mine,” accounting for 24.1 percent of all complaints in Q2, down slightly from 25.3 percent in Q1.

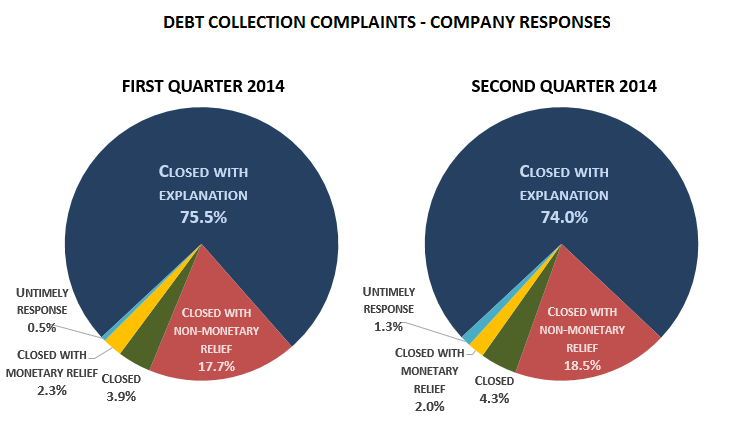

ARM companies responded to complaints in Q2 in a very similar fashion to Q1. Closing a complaint with explanation is the most popular response by companies, making up 74 percent of all complaints, down from 75.5 percent in Q1. There was a slight uptick in companies providing consumer non-monetary relief, with 18.5 percent doing so in Q2 compared to 17.7 percent in Q1. Only around two percent of debt collection complaints are closed with monetary relief.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)