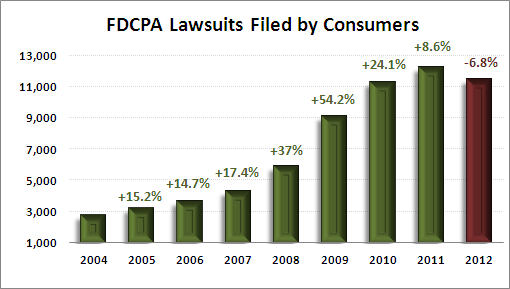

The total number of lawsuits filed in federal district courts by consumers seeking damages under the Fair Debt Collection Practices Act (FDCPA) declined nearly seven percent in 2012 after years of steady growth.

Just under 11,500 FDCPA lawsuits against debt collection and related companies were filed in 2012, according to data from WebRecon LLC. In 2011, there were 12,300 such lawsuits filed.

FDCPA cases filed in 2012 had been tracking lower than 2011 for most of the year. But around mid-year, it became apparent that 2012 could see a year-over-year decline. It was a significant development because it reversed a years-long trend in FDCPA case growth.

Since WebRecon started tracking cases claiming FDCPA violations in district courts, year over year growth in lawsuits has been strong. From 2006 to 2009, FDCPA cases jumped nearly 150 percent as consumers became more educated about the debt collection industry and plaintiff attorneys became more aggressive in their marketing efforts. From 2008 to 2009, the year-over-year growth rate peaked at 54 percent. But after 2009, the rate of growth slowed, with FDCPA cases up only 8.6 percent in 2011 compared to 2010.

As FDCPA cases have declined, lawsuits targeting the ARM industry claiming violations of other consumer statutes have increased. In 2012, cases claiming a violation of the Fair Credit Reporting Act (FCRA) were up 17 percent from 2011; cases claiming violations of the Telephone Consumer Protection Act (TCPA) were up nearly 34 percent.

The volume of FDCPA dwarfs those of FCRA and TCPA cases combined, but the rise in TCPA suits has caused concern among debt collectors.

In 2012, there were 2,249 FCRA suits filed and 1,101 TCPA claims made in court.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)