The Federal Reserve said Wednesday that the average 30-day delinquency rate on credit card accounts at commercial banks in the U.S. dropped to an all-time low in the second quarter of 2012, another warning sign to the ARM industry that the card sector is rapidly shrinking. Delinquency rates on home loans, meanwhile, increased for the second consecutive quarter.

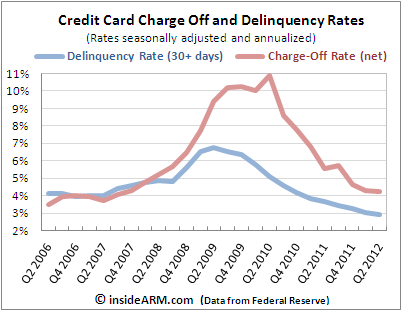

The Federal Reserve, in its quarterly data released titled Charge-Off and Delinquency Rates on Loans and Leases at Commercial Banks, said that the average 30-day delinquency rate for credit card loans in the second quarter was 2.89 percent. It was the lowest rate recorded by the Fed since it began tracking the date in 1991 and the only time the average rate has fallen below 3 percent. The second quarter measure reflected a 5.5 percent decline from the 3.06 percent rate reported for the first quarter of 2012.

Since peaking at 6.77 percent (an all-time high) in the second quarter of 2009, the average credit card delinquency rate reported by the Fed has been on a relentless downward push, going from all-time high to all-time low in less than three years (the first quarter of 2012 also set an all-time low for delinquencies).

Since peaking at 6.77 percent (an all-time high) in the second quarter of 2009, the average credit card delinquency rate reported by the Fed has been on a relentless downward push, going from all-time high to all-time low in less than three years (the first quarter of 2012 also set an all-time low for delinquencies).

The average charge-off rate for credit cards also fell in Q2 2012. Commercial banks in the U.S. reported an average card charge-off rate of 4.21 percent in the second quarter, down slightly from the 4.28 percent rate in the first quarter.

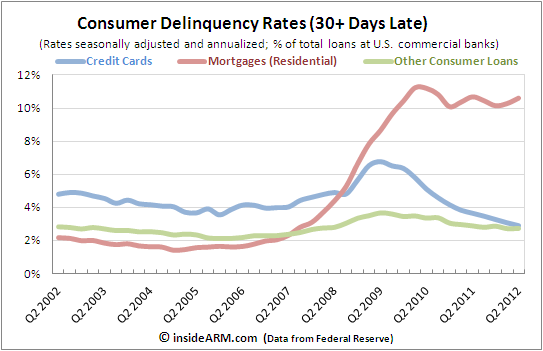

Late payments on residential home loans, including home equity lines of credit, increased to 10.61 percent in the second quarter, up from 10.28 percent in the first three months of 2011. It was the second straight quarter of increases for home loan late payments.

Mortgage and home equity loan delinquencies have remained stubbornly high over the past two years even as other consumer loan markets have corrected. The 30-day delinquent measure for residential home loans peaked at 11.24 percent in the first quarter of 2010 and has not dipped below 10 percent since. Before 2008, the historical average for home loan delinquencies was slightly below 2 percent.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)