The Consumer Financial Protection Bureau (CFPB) has been collecting consumer complaints on credit card companies since December 2011. While most of the complaints deal with billing and account matters, about 1,600 specifically site debt collection issues. The sample provides a bit of insight into what the ARM industry will be dealing with once the Bureau begins accepting third party debt collection complaints.

In late March, the CFPB released to the public all of the complaint data it has collected so far through its Consumer Response complaint system. Going forward, the data will be updated in near-real time, providing an open environment for oversight of its complaint process. The agency encouraged the public to pore through the more than 94,000 records to find trends in complaints about financial products.

The CFPB’s complaint data is meticulously cleaned and standardized. As a media outlet that has evaluated complaints from other federal agencies, we here at insideARM.com greatly appreciate that.

A little more than a third of the total complaints contained the word “collection” in the Issue field, the label that reveals what specific action the consumer is complaining about. The Issue field in Consumer Response is comprised of pre-selected issues the consumer can choose.

The vast majority of records with “collection” in the Issue field were related to mortgages. In fact, the pre-selected language for that particular label is “Loan modification, collection, foreclosure.” Within the context of those complaints, we felt it was safe to discard them as debt collection complaints as most clearly were dealing with loan modification issues and foreclosure attempts.

So that left 1,629 complaint records with the Issue field selection of either “Collection Debt Dispute” or “Collection Practices.” All of the complaints were related to credit card products. The collection complaints are fairly evenly split between Collection Debt Dispute and Collection Practices.

The major change the CFPB is bringing to financial product complaints is the three way communication protocol facilitated by the agency. When a complaint comes in against a company, it is almost immediately forwarded to the firm for a response. Once the company responds, the CFPB checks with the consumer to make sure the response is satisfactory. Each step is recorded and available in the complaint data.

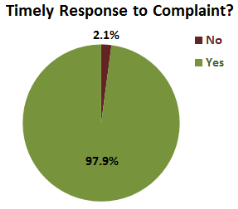

When the model was introduced, many in the ARM industry feared that it would lead to increased compliance costs. The CFPB requires a company to respond in a timely manner to a complaint, so inaction is not an option. This means that staff must be dedicated to the process of responding. And, indeed, the companies that have debt collection complaints so far have responded.

When the model was introduced, many in the ARM industry feared that it would lead to increased compliance costs. The CFPB requires a company to respond in a timely manner to a complaint, so inaction is not an option. This means that staff must be dedicated to the process of responding. And, indeed, the companies that have debt collection complaints so far have responded.

Nearly 98 percent of these complaints have been met with a timely response from the target company.

Like most other fields available in the Consumer Response system, a company’s response falls under a pre-set list of selections. There was another fear that many of the complaints would require some type of relief, either monetary or non-monetary. So far, however, the vast majority (71 percent) of company responses have not involved any relief at all, and even fewer have involved monetary relief (10 percent).

| Company response | % of complaints |

| Closed with explanation | 42.9% |

| Closed without relief | 28.3% |

| Closed with monetary relief | 10.6% |

| Closed with non-monetary relief | 9.5% |

| Closed with relief | 7.7% |

| Closed | 1.1% |

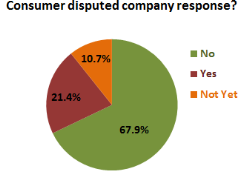

After a company responds, the consumer has an opportunity to dispute or accept the response. Of the 1,600+ debt collection complaints in Consumer Response, about 68 percent have seen company responses go undisputed. Another 10.7 percent are too recent to have gone through the process and thus have no consumer dispute record. The remaining 21 percent have seen the consumer dispute the company response.

When a consumer disputes a company’s response, the process becomes a bit murky. There is no data after that step in the process, but the CFPB said that it seeks in to bring a satisfactory resolution for both the company and consumer.

When a consumer disputes a company’s response, the process becomes a bit murky. There is no data after that step in the process, but the CFPB said that it seeks in to bring a satisfactory resolution for both the company and consumer.

Based on the credit card debt collection complaints the CFPB has received so far, the ARM industry does have work ahead of it in simply responding to and closing out complaints. But the process seems to be transparent and straightforward, at least judging by the data. We’ll see what happens when the complaints start rolling in.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)