Complaints about debt collection practices jumped nearly 20 percent in 2011, according to data released late Tuesday by the Federal Trade Commission. What mainstream media certainly won’t allude to, even though it’s explicit in the introduction of the FTC’s report, is that these are unverified complaints. This is all raw data. This is not any kind of analysis.

Of course, that doesn’t make for sexy ledes in stories about the horrors of the collection industry, so don’t expect this practice to change any time soon.

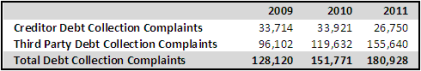

Additionally, complaints specifically regarding third-party debt collection agencies soared more than 30 percent, while, interestingly enough, creditors saw complaints about their internal debt collection efforts fall.

We can hazard some guesses about these numbers: As the ACA noted, technology has allowed more consumers to log complaints over the past ten years — so it’s now easier than ever to lodge a complaint, whether it’s legitimate or not, against a collection agency.

In 2011, more than 180,000 debt collection complaints were logged in the Consumer Sentinel Network (CSN) — a national database of consumer complaints administered and compiled by the FTC – a 19.2 percent increase from the 151,000 debt collection complaints in 2010.

Complaints about third-party collectors jumped 30.1 percent to 155,640 while complaints against first party (original creditor) collectors fell 21.1 percent to 26,750.

Complaints about third-party collectors jumped 30.1 percent to 155,640 while complaints against first party (original creditor) collectors fell 21.1 percent to 26,750.

Debt collection complaints in 2011 made up 10 percent of all complaints in the CSN, down slightly from 10.4 percent in 2010. Total complaints logged by the FTC jumped 23.5 percent in 2011 to 1.8 million.

Identity theft remained the most common complaint last year with 279,000. Complaints about credit cards increased 11.2 percent to 37,932, but 2011 marked the first year the credit card complaint category was not in the Top 10 list. Picking up the slack, complaints against banks and lenders saw the largest increase — 141 percent — to 89,341, making it the fifth-highest complaint category.

The FTC’s complaints report is compiled from a network of reporting groups that include the FTC itself – through its Web site, regular mail, or toll-free numbers – Better Business Bureau units, a handful of state enforcement groups like attorneys general, and private partners such as Publishers Clearing House and PrivacyStar. The FTC notes that the complaint numbers from CSN are “based on unverified complaints reported by consumers.”

The unverified nature of the reported complaints has been noted by many in the ARM industry as a primary reason the FTC’s numbers cannot be used as an accurate measure of consumer feelings toward collectors. Debt collection trade group ACA International noted Wednesday that many complaints in the CSN go unresolved. But one source of CSN data, the BBB, does allow businesses to respond, and the ARM industry has an 84 percent resolution rate of BBB complaints, higher than most industries.

“We take consumer complaints seriously and agree on the significant importance of protecting consumers against businesses that engage in deceptive, unfair or abusive practices,” said ACA CEO Pat Morris. “However, the FTC’s report doesn’t explain several relevant underlying factors contributing to the increase in the number of complaints against the third-party debt collection industry.”

ACA noted that technology has allowed more consumers to log complaints over the past ten years. And the FTC does not check any complaints against laws and regulations for violations.

The Top Ten Complaint Categories of 2011:

| Category | Number | % of Total Complaints |

| Identity Theft | 279,156 | 15 percent |

| Debt Collection | 180,928 | 10 percent |

| Prizes, Sweepstakes, and Lotteries | 100,208 | 6 percent |

| Shop-at-Home and Catalog Sales | 98,306 | 5 percent |

| Banks and Lenders | 89,341 | 5 percent |

| Internet Services | 81,805 | 5 percent |

| Auto Related Complaints | 77,435 | 4 percent |

| Imposter Scams | 73,281 | 4 percent |

| Telephone and Mobile Services | 70,024 | 4 percent |

| Advance-Fee Loans and Credit Protection/Repair | 47,414 | 3 percent |

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)