It has been well documented that both during and after the recent recession, consumers have shed a significant portion of their revolving debt. Prior TransUnion research has quantified that this balance reduction was a result of both charge-off and significant pay-down[1].

This observation leads to a natural next question: are consumers who pay down their balances truly deleveraging, i.e. reducing their usage of revolving credit, or are these consumers disengaging—looking to move their relationship(s) to other card lenders due to dissatisfaction with their current card lenders, although their appetite for revolving credit overall has not changed? We explored this dichotomy in greater detail through an original research study.

Classifications of Behavior

The study began with broad definitions to discern between consumers who appeared to be paying down their balances due to different “motivations.” This is a far more nuanced question than might appear on the surface, and a great deal of consideration and situational analysis must go into a study aiming to understand the drivers behind consumer credit behavior.

As of March 2010, several million eligible consumers were pulled anonymously from the TransUnion credit database. A credit snapshot of each was again taken as of September 2010. Between March and September 2010 (referred to as our “observation period”), we grouped consumers based on credit usage, limit changes, account closures and more.

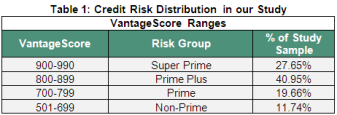

Between October 2010 and September 2011 (the “performance period”), consumer behavior was observed for each of our segments, including how consumers maintained their existing relationships and their appetites for new credit across product types. Finally, we used the VantageScore® credit score to control for risk (Table 1).

Between October 2010 and September 2011 (the “performance period”), consumer behavior was observed for each of our segments, including how consumers maintained their existing relationships and their appetites for new credit across product types. Finally, we used the VantageScore® credit score to control for risk (Table 1).

Our final analysis included 1.23 million consumers with increasing balances and 1.98 million consumers who were paying down their card balances.

Results

We found quite different behaviors among the various paydown segments, so much so that we labeled them Deleveraging and Disengaging, respectively. It is important to note that we did not attribute these names a priori but rather based them on exhibited behavior. The key point is that we were able to categorize consumers based on data available in the observation period, to distinguish between behaviors in the performance period.

Deleveraging and not-deleveraging consumers behave similarly

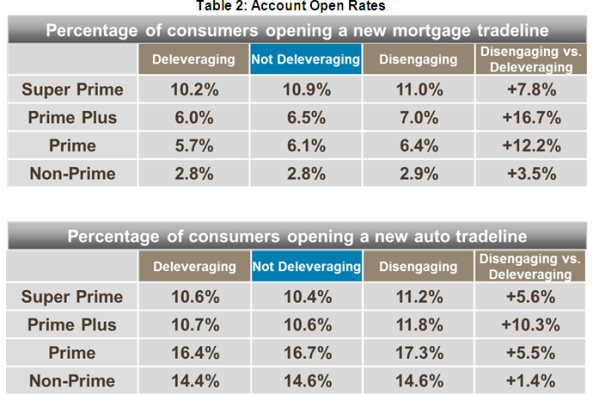

Deleveraging consumers opened new card accounts at a rate similar to their not-deleveraging counterparts, and carried similar average balances on those new card accounts. This credit appetite was not limited to cards but was found among auto loans and mortgages as well (Table #2). This supports the idea that deleveraging consumers do not exhibit dissatisfaction with any single lender; deleveraging is a matter of change in credit usage and not a loss of loyalty.

Disengaging consumers are different!

Within the performance period, disengaging consumers closed between 17-40% more card accounts than the not deleveraging population. Moreover, the disengaging population actively replaced those card relationships—on average, prime and better consumers in the disengaging segment opened 37% more new card accounts. And it wasn’t limited to card accounts only—across product types and the risk spectrum, the percentage of disengaging consumers opening a new account was greater than the other populations (see Table #2 again). Thus it appears that disengagement may extend to how consumers manage all of their credit relationships with a given institution, not just cards.

This behavior is significant on two fronts. If you can accurately identify a consumer who is disengaging around the time he actually disengages, you may find multiple product acquisition opportunities. However, from the perspective of relationship management, this development can spell trouble—not only is the card relationship already gone, but the consumer’s other relationships may follow if the disengagement is not identified and mitigated properly.

Summary

We have developed an approach to distinguishing between deleveraging and disengagement based on credit behavior in an observation period. This approach can allow lenders to identify each form of behavior and take appropriate action. The correct response to disengagement requires strategies to regain trust and rebuild loyalty, recognizing that the entire relationship can be at risk beyond the individual card relationship. The correct response to deleveraging is not a loyalty play (since it was never lost), but a recognition of the changing needs of the consumer. What is clear is that a change in consumer balance behavior should not be accepted at face value. Rather, one must identify the drivers of that change to ultimately understand the consumer’s intent and needs.

Ross Minervini contributed to this report.

Ross Minervini is director of business development in the financial services business unit of TransUnion. Ezra Becker is vice president of research and consulting in the financial services business unit of TransUnion. For more information on this topic, please contact Ross Minervini at rminerv@transunion.com.

[1] Detailed information on these studies available from TransUnion.

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)