As I was preparing a presentation this week, I came across this video in the student loan section of the CFPB website:

That’s Raj Date, former Deputy Director of the CFPB, talking about student debt. It’s not the most entertaining video you’ll ever watch, but I thought it was a good, plain English explanation that puts student loans in perspective for individuals and families. Here’s the problem: it’s been viewed only 1,911 times. The video was published in December 2012. That’s less than 300 views per month.

This is disappointing. Raj Date was the number two guy at the agency. His time was really valuable. He and others thought it was worth the investment to make this video. And then they put it on the shelf.

A great deal of time and money is being spent on supervision, enforcement, rule-making, and politics. Okay, perhaps that’s needed right now, for immediate problems. But that’s not going to get at one of the key root causes of our current mess; the lack of basic financial literacy.

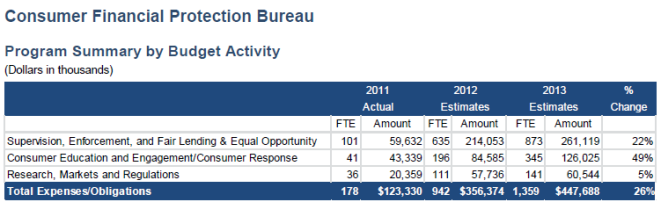

The CFPB budget estimate for 2013 shows 28% of the budget going to Consumer Education and Engagement/Consumer Response.

Consumer Response is the complaint program. Giving consumers that voice and avenue for resolution is important. But it’s also reactive. We’ve got to work this at both ends; otherwise the budget for handling complaints is going to increase forever.

How much of the 28% is being invested in proactive education? When the next generation becomes responsible, will we see a material reduction in how many consumers are in the mess we see today? Only if we throw just as much attention at that problem as we do to reactive enforcement, rulemaking, and enabling of those who would game the system on technicalities.

Three hundred views per month isn’t going to cut it when it comes to fundamental financial education for millions of Americans. Where is the mass media campaign? Where is the CFPB-sponsored version of The More You Know campaign? By the way, my hat is off to NBC Universal for running this campaign. Interestingly, among their list of very important topics (Internet safety, diversity, education, environment, and health) there is no mention of financial literacy and its threat to our country.

![Stephanie Eidelman [Image by creator from ]](/media/images/Stephanie_Eidelman-12.8.19.7e612703.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)