Consumers in the U.S. took on less credit card debt in August as banks continued to charge-off past due accounts, resulting in another net loss in card debt outstanding. The total amount due on credit card accounts fell to the lowest level since the financial crisis began.

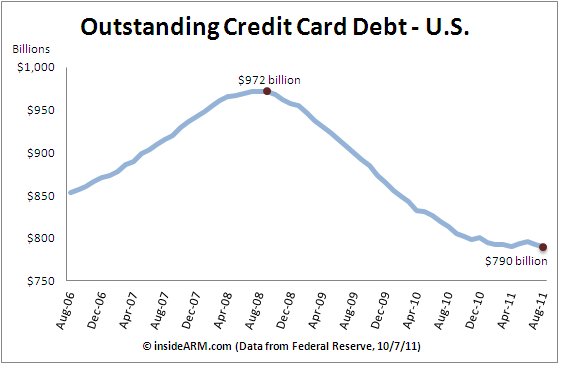

The Federal Reserve released data late Friday showing that its member banks reported a 3.4 percent annualized decline in card balances in August. Total revolving credit outstanding was $790 billion in the month, down from a peak of $972 billion in September 2008.

The Federal Reserve released data late Friday showing that its member banks reported a 3.4 percent annualized decline in card balances in August. Total revolving credit outstanding was $790 billion in the month, down from a peak of $972 billion in September 2008.

Total credit card debt plummeted in 2009 and 2010, with the fall largely leveling off so far in 2011. But monthly gains have been small and declines are still the norm. August marked the second-straight month of declines, and the third out of the past five months.

Overall consumer credit outstanding also fell, with non-revolving debt (like auto and student loans) declining at a 5.2 percent annual rate after a large gain (+11.3 percent) in July. The Fed’s report does not cover debt backed by real estate.

Total consumer debt outstanding in the U.S. was $2.445 trillion at the end of August.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)