U.S. consumers in May added $8 billion to their outstanding credit card bills, the largest increase since before the beginning of “The Great Recession.”

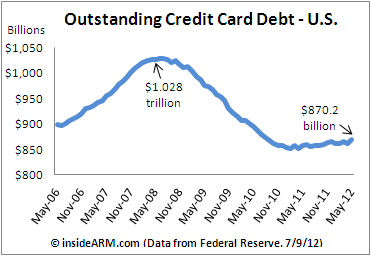

The Federal Reserve said in its monthly consumer credit data release (also known as G.19) that total consumer credit card debt outstanding at the end of May was $870.2 billion. The revolving debt numbers come straight from Fed member financial institutions.

Total revolving debt outstanding in May increased a seasonally adjusted 0.93 percent from April, marking the highest monthly increase since November 2007, a month before the recession officially began and nearly a year before the financial crisis of fall 2008.

May’s numbers continue a trend of positive growth for credit card debt that has been evident for more than a year.

Credit card debt outstanding exploded in the early to mid-2000s, peaking at more than $1 trillion in July 2008. After the financial collapse of October 2008, banks began charging off their credit card debt at a record pace, and enacted stricter lending standards which limited the availability of credit. Total credit card debt outstanding contracted by more than $150 billion in less than three years.

Credit card debt outstanding exploded in the early to mid-2000s, peaking at more than $1 trillion in July 2008. After the financial collapse of October 2008, banks began charging off their credit card debt at a record pace, and enacted stricter lending standards which limited the availability of credit. Total credit card debt outstanding contracted by more than $150 billion in less than three years.

But in March 2011, card debt started to grow again. In the 14 months since then, consumers have added nearly $15 billion in debt to their credit card accounts.

The Fed said that other consumer lending also increased in May. Non-revolving debt – mostly comprised of auto and student loans – grew by $9.1 billion in the month. The Fed’s G.19 report does not include debt backed by real estate.

Related Content:

- Settlements in Full: What Every Debt Collection Agency and Credit Issuer Needs to Know to Recover the Most Debt

- Collection Agency Financial Benchmark Report 2011

- The Debt Collection Compliance Handbook

- Debt Settlement Survey: How Creditors and Collectors Increase Collections

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)