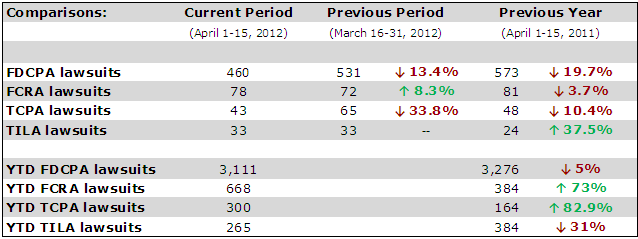

The number of lawsuits filed in the first half of April under the Fair Debt Collection Practices Act (FDCPA) and other consumer statutes slowed down compared to an active March. From April 1 to April 15, FDCPA lawsuits filed against ARM companies were down 13 percent compared to the previous period and were down close to 20 percent compared to the same period a year ago.

For the year, FDCPA lawsuits are down 5 percent compared to this time in 2011. FDCPA suits in the first half of April dropped in part because three full weekends fell in this short 15-day period.

Lawsuits filed under the Fair Credit Reporting Act (FCRA) crept up in the first half of April as TCPA fell.

The following statistics are provided courtesy of WebRecon LLC.

FDCPA and Other Consumer Lawsuit Statistics, April 1-15, 2012

Full Statistics:

There were about 518 lawsuits filed under consumer statutes in the first half of April 2012. Here is an approximate breakdown:

- 460 FDCPA

- 78 FCRA

- 43 TCPA

- 33 TILA

Summary:

- Of those cases, there were about 545 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 183, or 34%, had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 1040 lawsuits since 2001

- Actions were filed in 112 different US District Court branches.

- About 562 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 31 Lawsuits: Illinois Northern District Court – Chicago

- 28 Lawsuits: Colorado District Court – Denver

- 28 Lawsuits: California Central District Court – Western Division – Los Angeles

- 22 Lawsuits: Pennsylvania Eastern District Court – Philadelphia

- 20 Lawsuits: California Southern District Court – San Diego

- 19 Lawsuits: New York Eastern District Court – Brooklyn

- 16 Lawsuits: Minnesota District Court – Dmn

- 14 Lawsuits: Tennessee Eastern District Court – Greeneville

- 14 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 12 Lawsuits: New York Eastern District Court – Central Islip

The most active consumer attorneys were:

- Representing 16 Consumers: Sergei Lemberg

- Representing 15 Consumers: David M Larson

- Representing 11 Consumers: Everett H Mechem

- Representing 10 Consumers: Joseph M Meinhardt

- Representing 10 Consumers: Dennis R Kurz

- Representing 9 Consumers: George T Martin Iii Iii

- Representing 9 Consumers: Craig T Kimmel

- Representing 9 Consumers: Gary D Nitzkin

- Representing 9 Consumers: Joshua B Swigart

- Representing 8 Consumers: Alan C Lee

Statistics Year to Date

3557 total lawsuits for 2012, including:

- 3111 FDCPA

- 668 FCRA

- 300 TCPA

- 265 TILA

Number of Unique Plaintiffs: 3650 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 97 Consumers: Sergei Lemberg

- Representing 92 Consumers: David M Larson

- Representing 81 Consumers: Craig T Kimmel

- Representing 70 Consumers: David J Philipps

- Representing 53 Consumers: Everett H Mechem

Creditors and collection firms use WebRecon’s services to easily segregate predictably litigious consumers from their databases. A significant percentage of consumer litigation is initiated by the same consumers over and over again, and screening them out of the general population can reduce lawsuits significantly.

WebRecon LLC is transforming into the Bureau of Litigant Data, and as a result will be able to track even more useful data in the coming months and years, including data on non-filed litigation demand attempts. For more information on our consumer litigant batching, monitoring and searching service, please visit www.webrecon.com or call (616) 682-5327.

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)