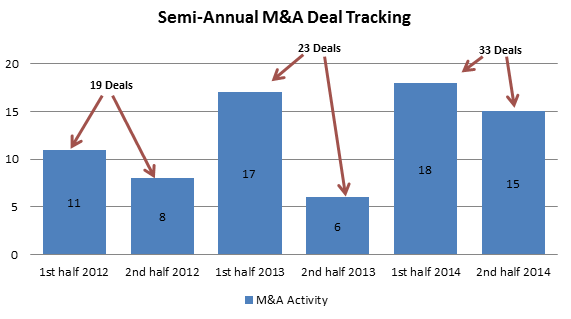

Faced with numerous challenges over recent years – including fiscal regulation, economic variability and seemingly erratic client behaviors – buyers and sellers of U.S. ARM companies have been reluctant to complete mergers and acquisitions. That is, until now. Over the past six months, we have experienced a flurry of M&A activity, and we are confident this trend will continue in 2015 for the following reasons:

1. Driven by an owner’s desire to sell, or an investor’s desire to cash in or out, plans that were delayed due to market conditions or regulatory anxiety are starting to come to fruition and will drive M&A activity in 2015.

2. We expect to see a strong wave of consolidation among collection agencies and law firms over the next 18-24 months as smaller and midsize service providers find it increasingly more challenging to operate profitably as a stand-alone business. Larger corporations are simply better situated to absorb the increased costs associated with regulatory compliance in today’s modern world of collections.

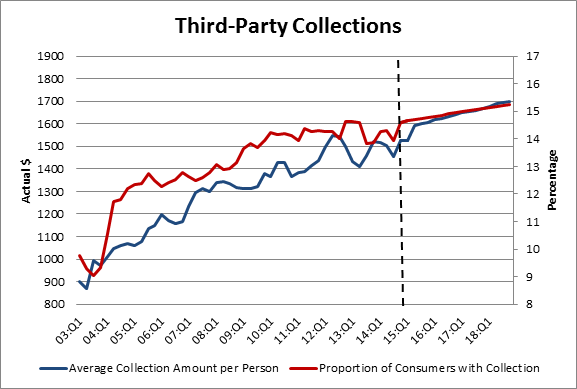

3. We expect that more consumers will wind up in collections and the average account balance will increase overall, as illustrated in the following chart. These trends bode well for ARM companies well-positioned to receive the windfall of new placements.

3. We expect that more consumers will wind up in collections and the average account balance will increase overall, as illustrated in the following chart. These trends bode well for ARM companies well-positioned to receive the windfall of new placements.

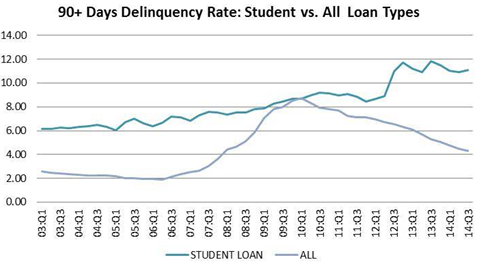

4. Interest is building up among buyers and investors in the student loan market segment. As the U.S. Department of Education gets its act together with the current contract renewal, M&A transactions will occur in this sector.

4. Interest is building up among buyers and investors in the student loan market segment. As the U.S. Department of Education gets its act together with the current contract renewal, M&A transactions will occur in this sector.

5. Financial trends have improved and will drive more M&A activity because…

5. Financial trends have improved and will drive more M&A activity because…

- Bank financing is more readily available at attractive rates and terms.

- Corporations have significant cash reserves for finance transactions.

- Interest rates are expected to remain low into the foreseeable future.

6. Significant expansion is forecasted in the government and health care sectors, attracting considerable interest among strategic and financial buyers seeking to enter or expand positions in these ARM market segments.

7. ARM companies wishing to offset risks of fluctuations within their particular market segments are turning toward M&A for rapid diversification, acquiring or merging with other businesses to expand their services offerings, client base and/or their geographic footprint.

8. Trends are developing in the technology-vendor segment of the ARM industry, leading to an uptick in deal activity. The increasing importance on regulatory compliance since the launch of the CFPB and growing involvement by the FTC and FCC have been a boon to technology and vendor companies. Expect to see greater levels of investment in these industries that support the ongoing development of the ARM industry.

9. We expect to see an influx of private-equity-influenced transaction as more and more of them come off the sidelines as buyers or sellers of ARM companies in 2015.

10. Because of the intense regulatory environment and the increased demands placed on collection agencies by credit grantors across virtually all market segments, fewer successful start-ups will emerge, and acquiring an established ARM company will be more desirable for new entrants than starting a new firm.

![Company logo for Kaulkin Ginsberg [Image by creator from Kaulkin Ginsberg]](/media/images/kgc-logo.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)